Optimism is high with the price of the cryptocurrency up 1,438 per cent over the past 12 months, but the very factor enthusiasts like most about bitcoin is also one of its biggest drawbacks.…

Enthusiasts like bitcoins because their supply is limited. The pace at which bitcoin “miners” can create new units automatically declines over time, with the maximum possible number of bitcoins fixed at 21 million. To converts, that limit means that bitcoins, unlike the fiat currencies issued by the world’s central banks, can never be debased by governments intent on printing as much money as it takes to pay off their debts.

Yet despite their scarcity, bitcoins possess no intrinsic value. Unlike hard commodities – copper, say, or even gold – bitcoins have no utility value. And unlike securities such as bonds or stocks, bitcoins do not carry the promise of a future cash flow that allows investors to put a hard figure on their value today.

Bitcoin enthusiasts argue that much the same can be said for fiat currencies. With interest rates around the world close to zero or even negative, conventional currencies also offer no income streams, and hence carry no real value. They are nothing more than an illusion, a confidence trick perpetrated by cynical governments on their gullible populations.

But that argument misses a crucial point. Fiat currencies do have an inherent value. The US dollar, for example, has value because the US government insists that Americans must pay their taxes in US dollars. And if they fail to pay their taxes, the US government will send them to jail (unless, of course, they are rich enough to employ expensive accountants and lawyers to devise legal tax dodges). That threat creates an underlying demand for US dollars which lends the currency a real value....

Chartalism rules!

More in the full article.

South China Morning Post

Why Bitcoin Fever Is a Bubble Waiting to Burst

Tom Holland

The issue is the numeraire that connects financial instruments/assets to non-financial assets/goods. A currency cannot be a numeraire. There are various choices of numeraire. This post argues for gold based on the historical norm. Another is a unit of labor, such as the JG compensation for an hour of unskilled labor (work without addition of "human capital"). Another is a unity of energy such as a barrel of oil (energy source) or a kilowatt hour (standard of energy output).

Gold is very useful since it has a long track record as the numeraire and many people use it in their analysis. However, labor and energy are more relevant economically. In addition, those that argue that gold is a "money" and also champion gold as the numeraire are contradicting themselves.

Anyway, the post is worth reading about a numeraire as a standard of measurement.

Zero Hedge

Bitcoin Hyper-Deflation, Gold and Silver Report 10 Dec 2017

Why Bitcoin Fever Is a Bubble Waiting to Burst

Tom Holland

The issue is the numeraire that connects financial instruments/assets to non-financial assets/goods. A currency cannot be a numeraire. There are various choices of numeraire. This post argues for gold based on the historical norm. Another is a unit of labor, such as the JG compensation for an hour of unskilled labor (work without addition of "human capital"). Another is a unity of energy such as a barrel of oil (energy source) or a kilowatt hour (standard of energy output).

Gold is very useful since it has a long track record as the numeraire and many people use it in their analysis. However, labor and energy are more relevant economically. In addition, those that argue that gold is a "money" and also champion gold as the numeraire are contradicting themselves.

Anyway, the post is worth reading about a numeraire as a standard of measurement.

Zero Hedge

Bitcoin Hyper-Deflation, Gold and Silver Report 10 Dec 2017

Tyler Durden

related

Bloomberg View

What's the Value of Bitcoin? Who Knows

Justin Fox

also

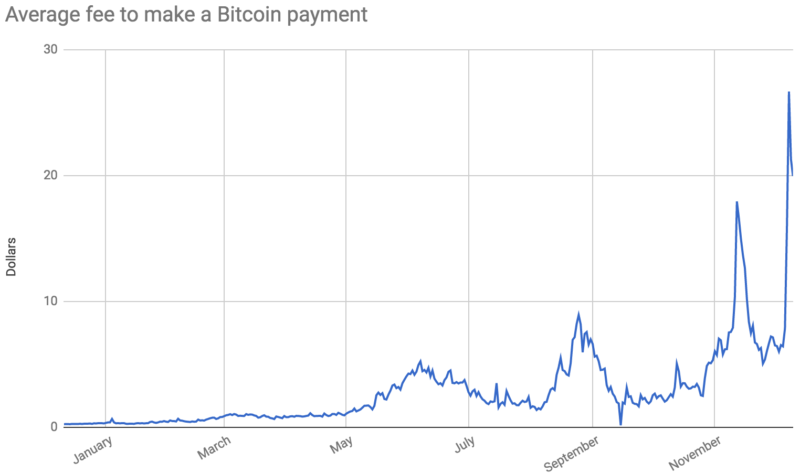

If there is increased efficiency and lower transaction cost, this will happen.

Russia May Turn To Oil-Backed Cryptocurrency To Challenge Sanctions & The Petrodollar

also

Russia Insider

Russia May Join Venezuela with an Oil Cryptocurrency

related

Unlike tangible gold and silver, digital currencies haven't had hundreds of years to prove their durability.Justin Fox doesn't seem to have heard of taxation driving currency. But otherwise interesting.

Bloomberg View

What's the Value of Bitcoin? Who Knows

Justin Fox

also

If there is increased efficiency and lower transaction cost, this will happen.

Russia May Turn To Oil-Backed Cryptocurrency To Challenge Sanctions & The Petrodollar

also

Russia Insider

Russia May Join Venezuela with an Oil Cryptocurrency

Timothy B. Lee

No comments:

Post a Comment